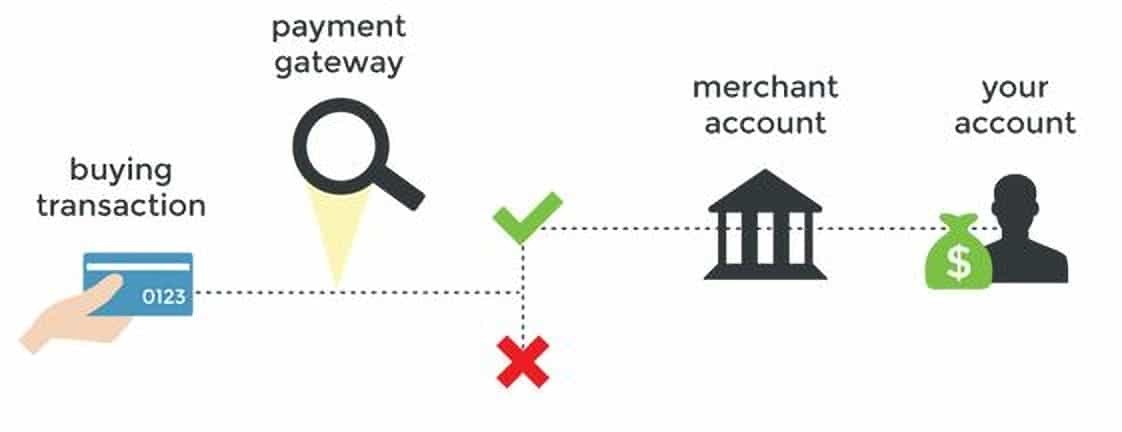

For companies of all kinds, payment gateways are essential in the modern digital economy. They operate as a link between customers and businesses during online transactions, guaranteeing the safe processing of payments made with credit, debit, and digital wallets. Even though these services’ security and convenience are indisputable, many organizations ignore the accompanying expenses. Ignoring payment gateway fees may have a big negative impact on your business, putting you in danger of financial hardship and overall profitability.

The Payment Gateways’ Undisclosed Expenses

A lot of companies, especially small and medium-sized firms (SMEs), are unaware of all the costs associated with payment gateways. These expenses may include of setup charges, chargeback fees, monthly service fees, and transaction fees. These costs may vary significantly between payment processors, and some could impose additional charges for transactions made outside of the country. Financial troubles and budget overruns may result from the budgeting process’s failure to account for these items. This oversight may impede cash flow, which makes it more difficult for companies to cost of payment gateway or put money back into expansion plans.

Increased Overhead and Debt Pressure

Businesses often have to cope with exorbitant overhead when they fail to account for the expenses related to payment gateways. The total impact of transaction fees may significantly reduce profitability, especially for companies with high volumes. Consequently, costs may skyrocket, and the resulting financial pressure may compel businesses to make further adjustments, such layoffs or a reduction in marketing expenditures. This downward cycle may seriously curtail a company’s growth potential and put further demand on its resources, which will eventually make it more difficult for it to compete in the market.

Diminished Profitability: The Immediate Effect

It is impossible to overestimate the relationship between payment gateway expenses and profitability. Even with a high amount of transactions, a business’s earnings may decline if a significant portion of each transaction is lost to processing costs. The firm may find it challenging to remain viable in the long run due to this decline in profit margin. To counterbalance these expenses, businesses could be inclined to boost prices, but doing so might drive away consumers and reduce sales. Sustaining profit margins requires striking a balance between competitive pricing and operating expenses.

The Value of Cost-Benefit Evaluation

Companies need to regularly do cost-benefit evaluations to steer clear of the traps associated with unnoticed payment gateway expenses. Through a comprehensive analysis of the costs linked to various payment processors, enterprises may arrive at well-informed choices that complement their financial plans. Comparing choices might help you find more affordable suppliers and expedite the payment procedure. Additionally, by comprehending the charge structures, companies may create pricing strategies that meet costs without compromising profits.